Free Printable:_1cuehjbasi= Low Income Budget Beginner Printable Budget Worksheet

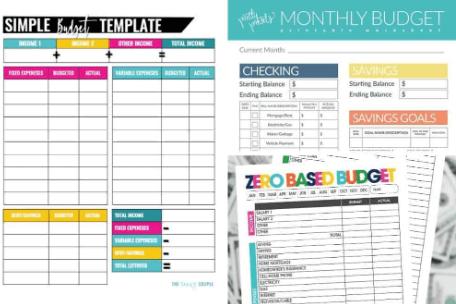

The “Free Printable:_1cuehjbasi= Low Income Budget Beginner Printable Budget Worksheet” serves as a practical tool for individuals striving to enhance their financial management capabilities. By providing a structured format to outline income and expenditures, it facilitates a clearer understanding of one’s financial landscape. However, effectively utilizing this worksheet requires more than just filling in numbers; it necessitates a strategic approach to budgeting. As we explore how to maximize the benefits of this resource, it becomes evident that there are critical insights and techniques that can significantly influence one’s financial journey.

Understanding Your Financial Situation

Before you can create an effective budget, it is essential to gain a clear understanding of your financial situation.

Begin by defining your financial goals, as they will guide your budgeting process.

Implementing expense tracking allows you to monitor spending patterns and identify areas for improvement.

This clarity empowers you on your journey to financial freedom, enabling informed decisions that align with your aspirations.

Read Also: Food:26uv15zsvio= Sweets

How to Use the Budget Worksheet

Having established a clear understanding of your financial situation, you can now effectively utilize a budget worksheet to take control of your finances.

Begin by setting goals that align with your values and aspirations.

Next, use the worksheet for tracking expenses, ensuring that every dollar is accounted for.

This practical approach empowers you to make informed decisions, fostering financial freedom and stability.

Tips for Effective Budgeting

Effective Free Printable:_1cuehjbasi= Low Income Budget Beginner Printable Budget Worksheet is an essential component of financial wellness, enabling individuals to allocate their resources wisely and achieve their financial objectives.

Implementing effective savings strategies is crucial, as is diligent expense tracking. Regularly review your spending habits to identify areas for improvement, and adjust your budget accordingly.

This proactive approach fosters financial freedom, empowering you to make informed decisions about your money.

Additional Resources for Budgeting

Exploring additional resources for budgeting can significantly enhance your financial management skills and empower you to make informed decisions.

Utilizing budgeting apps can streamline your tracking process and improve your financial literacy.

Furthermore, online courses and community workshops provide valuable insights into effective budgeting techniques.

Read Also: Free Printable:1dgi4rjyifg= Ornament Coloring Pages

Conclusion

In conclusion, the “Free Printable:_1cuehjbasi= Low Income Budget Beginner Printable Budget Worksheet” serves as a practical tool for individuals seeking financial clarity and empowerment. By systematically outlining income and expenses, users can navigate their financial landscape with confidence. Imagine transforming financial anxiety into a roadmap for success; this worksheet offers the first step toward achieving that vision. Embracing budgeting not only fosters accountability but also paves the way for a more secure and prosperous future, making financial dreams attainable.